How to sell to investors: A data‑backed playbook for earning attention and funding

fizkes // Shutterstock

How to sell to investors: A data‑backed playbook for earning attention and funding

Investors move fast. Whether they’re venture capitalists, angels, or corporate venture arms, they’re constantly filtering deal flow, scanning market trends, and evaluating pitches — all while juggling portfolio oversight.

To earn their attention, your outreach needs to match their cadence: concise, relevant, and perfectly timed.

Apollo’s analysis of hundreds of thousands of investor‑level email interactions in 2025 uncovered the best times to engage, the themes that get replies, and the messaging frameworks that actually convert interest into conversations.

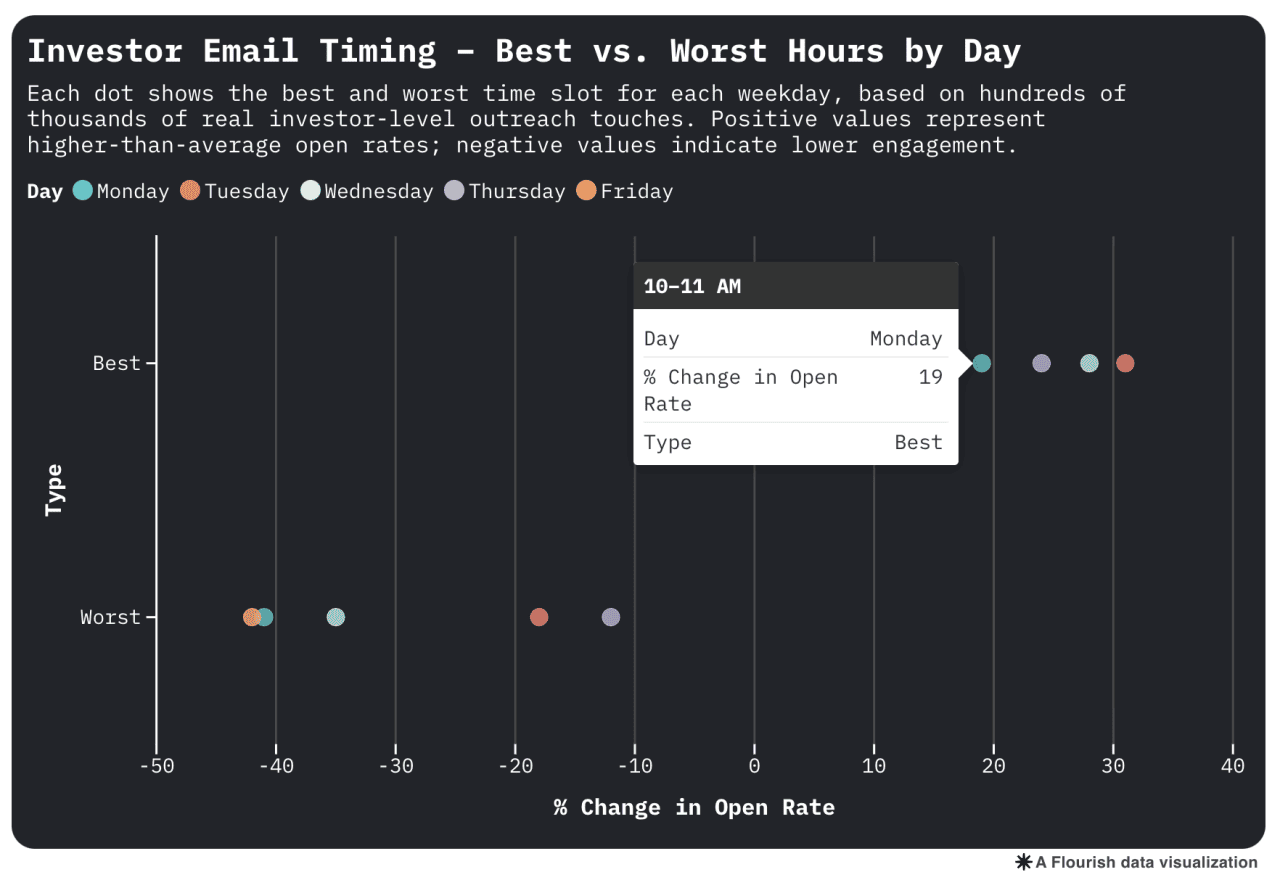

Best and Worst Times to Email Investors

Note on time zones: All times in this report are recorded in UTC (Coordinated Universal Time). For U.S. recipients, subtract about four to eight hours, depending on the time zone, to get the real sending window.

The right timing isn’t just about avoiding investor “no‑go” hours — it’s about catching them when they’re mentally open to exploring opportunities.

The data shows Thursday at 7 a.m. UTC is the single best slot, driving an 18.56% open rate. In most U.S. time zones, that lands in the early morning hours, when inbox competition is lower and deal‑minded investors are prepping for the day.

Late‑night outreach also works: Sunday at 9 p.m. UTC (Sunday afternoon in the U.S.) sees above‑average performance, likely tied to investors reviewing their upcoming week’s schedule.

The worst times? Late‑night Friday UTC and midday Tuesday — moments when investors are either mentally checked out for the weekend or buried in back‑to‑back meetings.

Apollo.io

Actionable Takeaway: Target early morning Thursday UTC (Wednesday night in the U.S.) to catch investors in high‑receptivity mode. Avoid Friday night UTC and midweek afternoon lulls when attention is lowest.

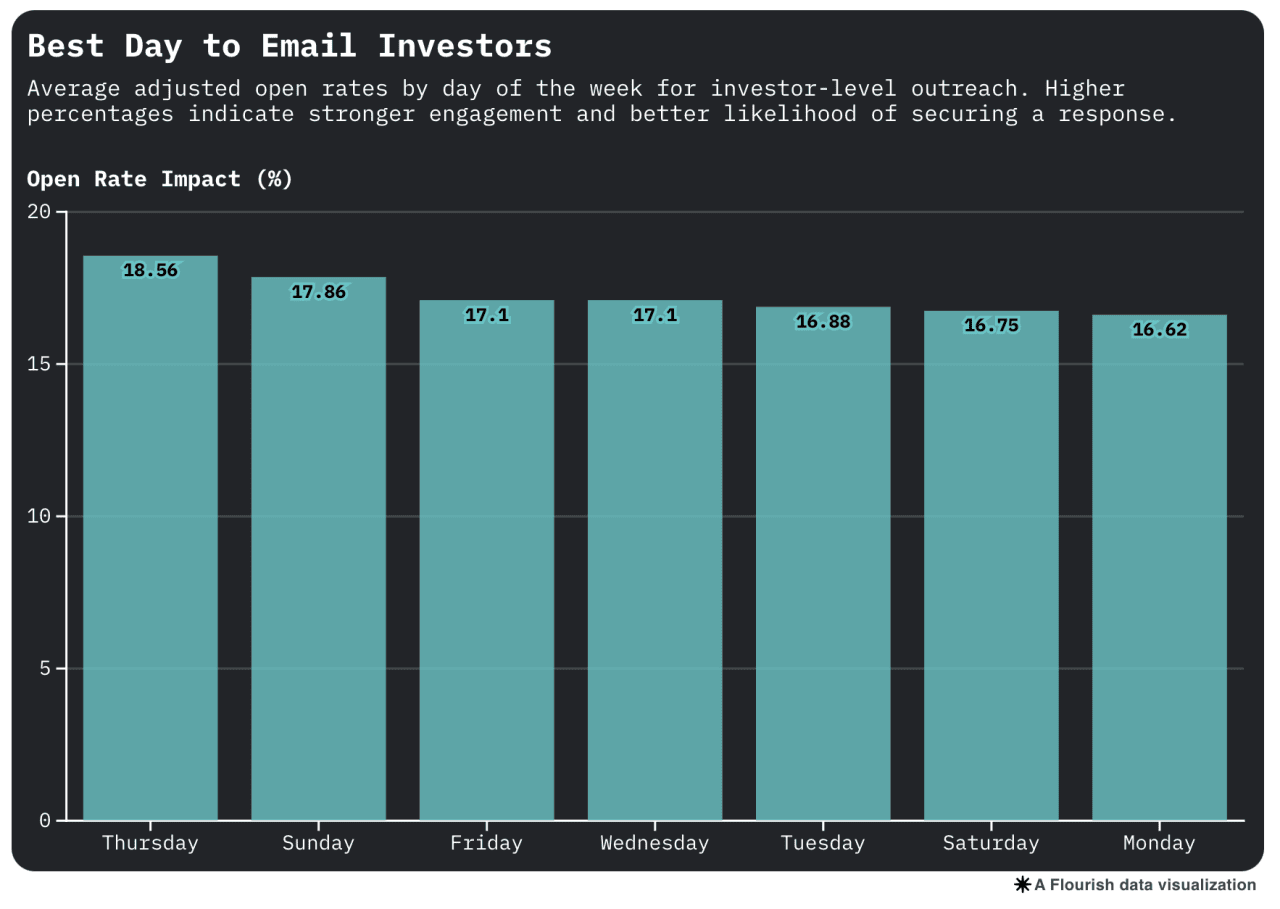

Best Day of the Week to Email Investors

Investors check their inbox daily, but when your email lands has a big influence on whether they actually engage.

Apollo’s dataset shows Thursday is the best day for investor outreach, closely followed by Friday and Monday.

Why Thursday? It’s far enough into the week that urgent portfolio fires are handled, but early enough that there’s still time to act on promising leads before the weekend. Friday’s strength comes from “inbox triage” mode before they sign off. Monday works when your message aligns tightly with their week’s strategic priorities.

Midweek (Tuesday or Wednesday) dips slightly — these are high‑meeting days for most investors. Saturdays lag, as many are offline or focused on personal commitments.

Apollo.io

Actionable Takeaway: Send Thursday morning UTC (Wednesday night in the U.S.) for maximum impact. If you miss that slot, Friday early UTC still delivers strong performance.

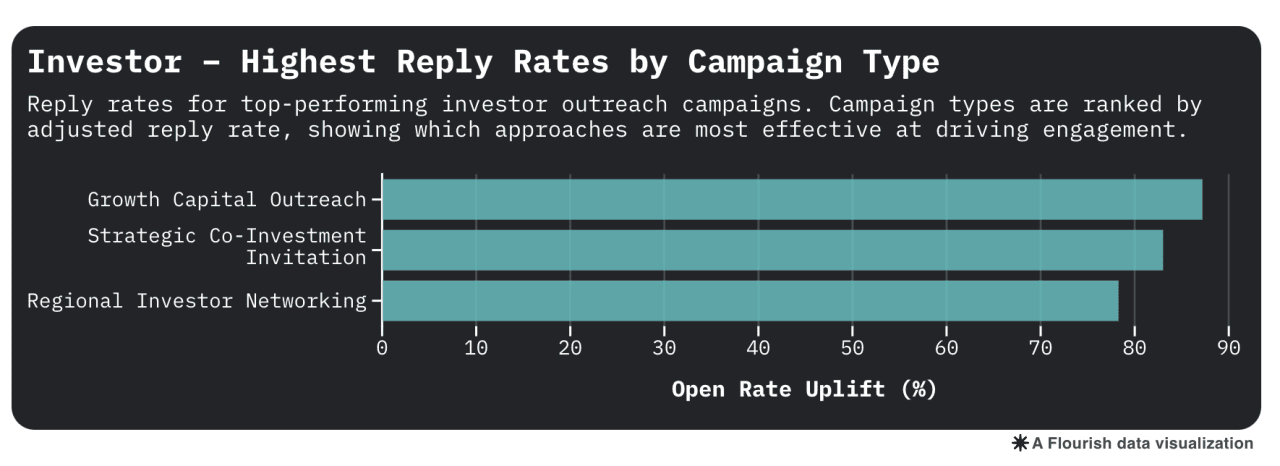

Top‑Performing Campaign Types for Investors

Not every investor email lands the same way. The highest‑reply campaigns in this analysis share three traits.

- Specific opportunity framing – They clearly communicate the deal thesis or investment angle.

- Credibility – They include concrete traction, market data, or founder pedigree.

- Low‑friction call to actions – They make it easy to take the next step (e.g., short call, deck review).

Apollo.io

Actionable Takeaway: Lead with a clearly defined opportunity, back it with proof, and invite investors into a simple, concrete next step.

Email Templates That Investors Actually Respond To

1. Growth Capital Hook

When to use it: You have a company in rapid expansion mode seeking funding.

Why it works: It shows traction first, positioning it as a qualified opportunity.

Subject: Growth capital opportunity – {{company}}

Hi {{first_name}},

I’m reaching out regarding a fast‑growing company generating {{traction_metric}} in ARR with {{growth_stat}} growth.

We’re now seeking a strategic partner to accelerate expansion. Our model is capital‑efficient, with clear paths to scaling in {{market}}.

Would you be open to reviewing the short investment deck?

Best,

[Your Name]

2. Co‑Investment Invite

When to use it: You’ve identified alignment with another investor’s portfolio or thesis.

Why it works: It leverages shared context and derisks the investment conversation.

Subject: Potential co‑investment in {{sector}}

Hi {{first_name}},

We’re in discussions with {{other_investor_name}} on a round for a high‑growth {{market}} company. Given your focus on {{investment_focus}}, I believe this could be an excellent fit.

Happy to share the deck and deal details if you’re interested.

Best,

[Your Name]

What NOT to Do When Emailing Investors

- Send vague “we’re raising” emails with no proof of traction.

- Hide the ask — be clear on your funding target.

- Blast at random times without timing the strategy.

- Skip research — investors spot spray‑and‑pray instantly.

Key Takeaways

- Thursday early UTC is your prime slot.

- Lead with deal specifics and proof, not fluff.

- Keep your CTA short, clear, and low‑commitment.

Data Methodology

This analysis is based on Apollo’s proprietary dataset of hundreds of thousands of investor‑level email interactions in 2025, analyzed for optimal timing, day, and campaign style effectiveness.

This story was produced by Apollo.io and reviewed and distributed by Stacker.

![]()