Love and money: The reality of couples’ finances before marriage

Love and money: The reality of couples’ finances before marriage

How do couples today handle their finances before getting married? To find out, in August 2024 SoFi surveyed 450 adults who live with their partners (and intend to get married within the next three years) about money, relationships, and plans for the future.

The results suggest that the majority of committed couples are open with each other about money and debt, are relatively aligned in their financial goals, and plan to talk about money at least monthly after marriage. That said, many have occasional disagreements over money and are worried about expenses, debt, and saving for the future.

Learn how other couples’ financial habits compare to yours, and get tips for dealing with love and money in a relationship.

Key findings

Some highlights of SoFi’s 2024 Love and Money survey of soon-to-be married couples include:

- More than one-quarter (28%) of survey respondents share a joint bank account with their partner before marriage.

- 75% of partners are very comfortable discussing money matters with their partner.

- 40% of cohabitating couples sometimes disagree about finances.

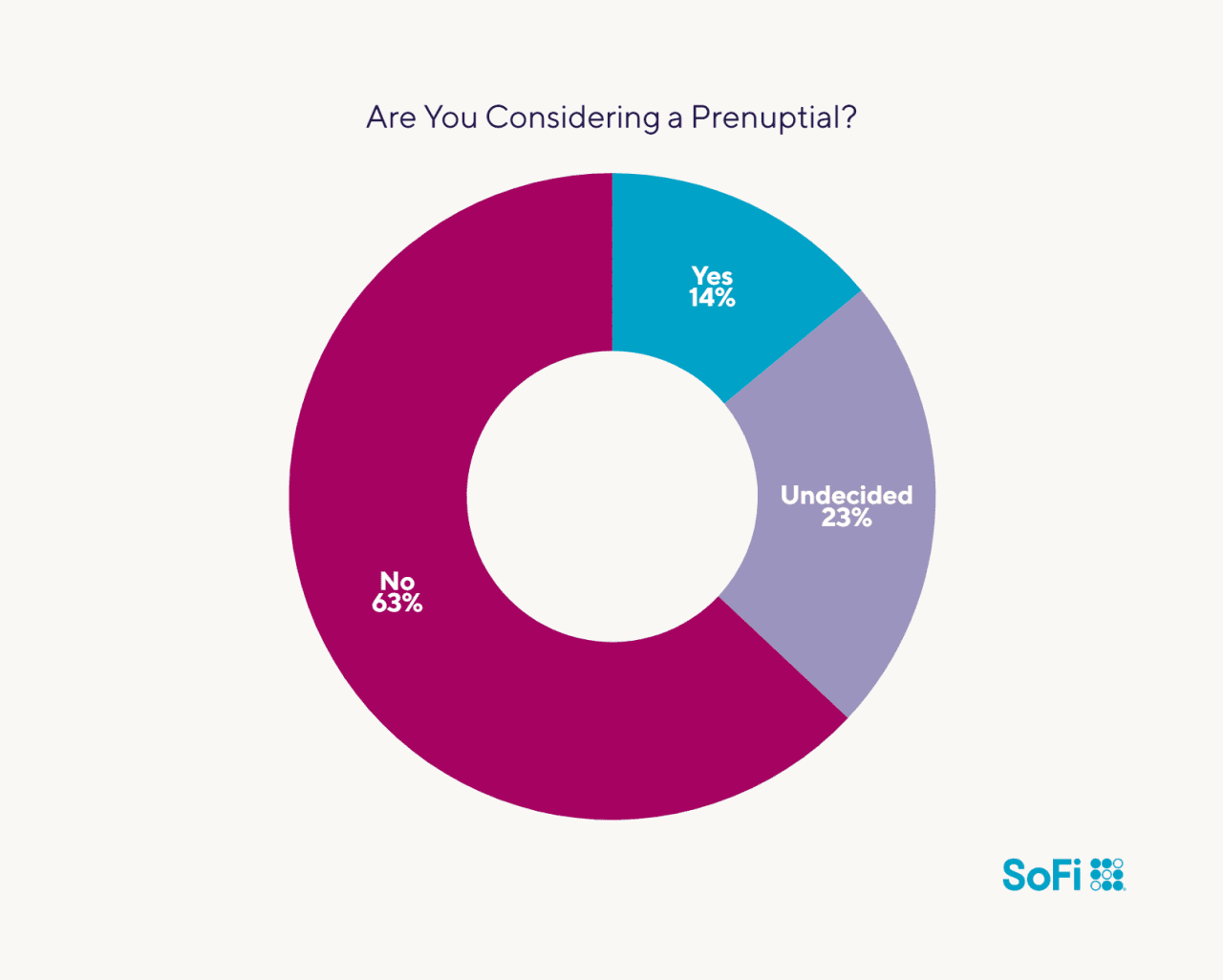

- Only 14% of those surveyed are considering a prenup.

- Nearly 1 in 5 (18%) of couples have postponed their wedding to save more money.

- 28% of respondents are thinking of postponing their wedding to save money, but they haven’t discussed the idea with their partner.

Financial transparency before marriage

Overall, most couples today aren’t shy about sharing details about their finances. Many have discussed everything from the amount of debt they owe to their credit scores.

SoFi

75% are very comfortable discussing money before marriage

Although money issues can be difficult to talk about, discussing finances before marriage can help couples build a solid financial foundation for their future together.

The participants in the SoFi survey seem to be on the right track: Three-quarters said they freely discuss finances with their partner. Another 18% are somewhat comfortable having money talks, while around 6% are either neutral or somewhat uncomfortable. Better yet: Not even one survey respondent said they were very uncomfortable discussing finances with their future spouse.

About 1 in 3 respondents said they started saving for their golden years between the ages of 25 to 35, while 17% began before age 25. That’s a positive sign, as getting an early start means more time to capitalize on the power of compounding returns. However, roughly 1 in 3 adults said they didn’t start saving until after the age of 36, and 13% said they had yet to put a retirement plan into action.

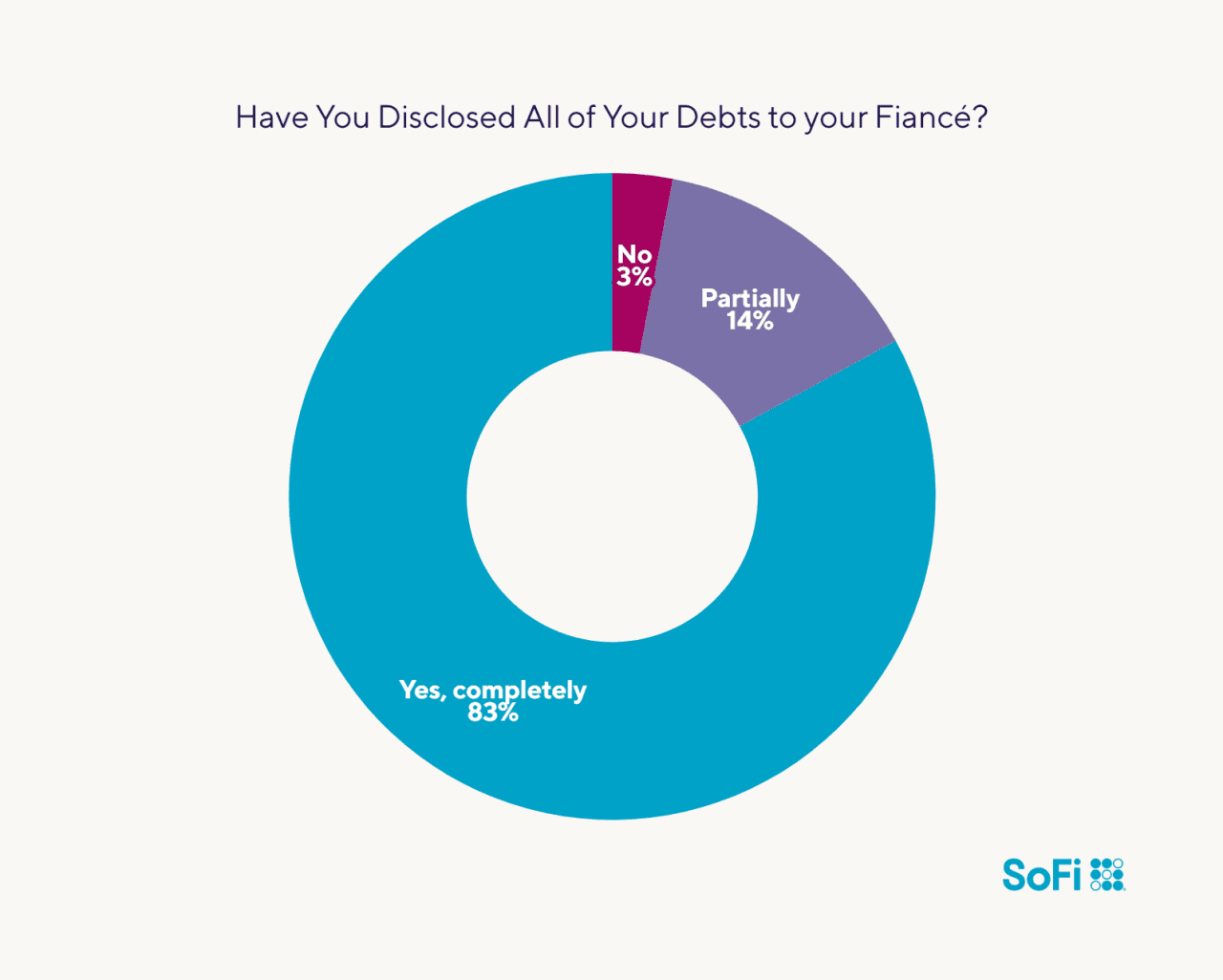

83% disclose their debt

Transparency about debt is key for couples, particularly if you plan to get married. Being aware of how much combined debt you owe allows you to come up with strategies for paying it down and building financial security. Hiding debt, on the other hand, can lead to distrust in the relationship.

SoFi

The good news is that the majority of survey participants (83%) have told their partner about all the debt they owe. Another 14% have partially disclosed their debt, and just 3% haven’t revealed their debt at all.

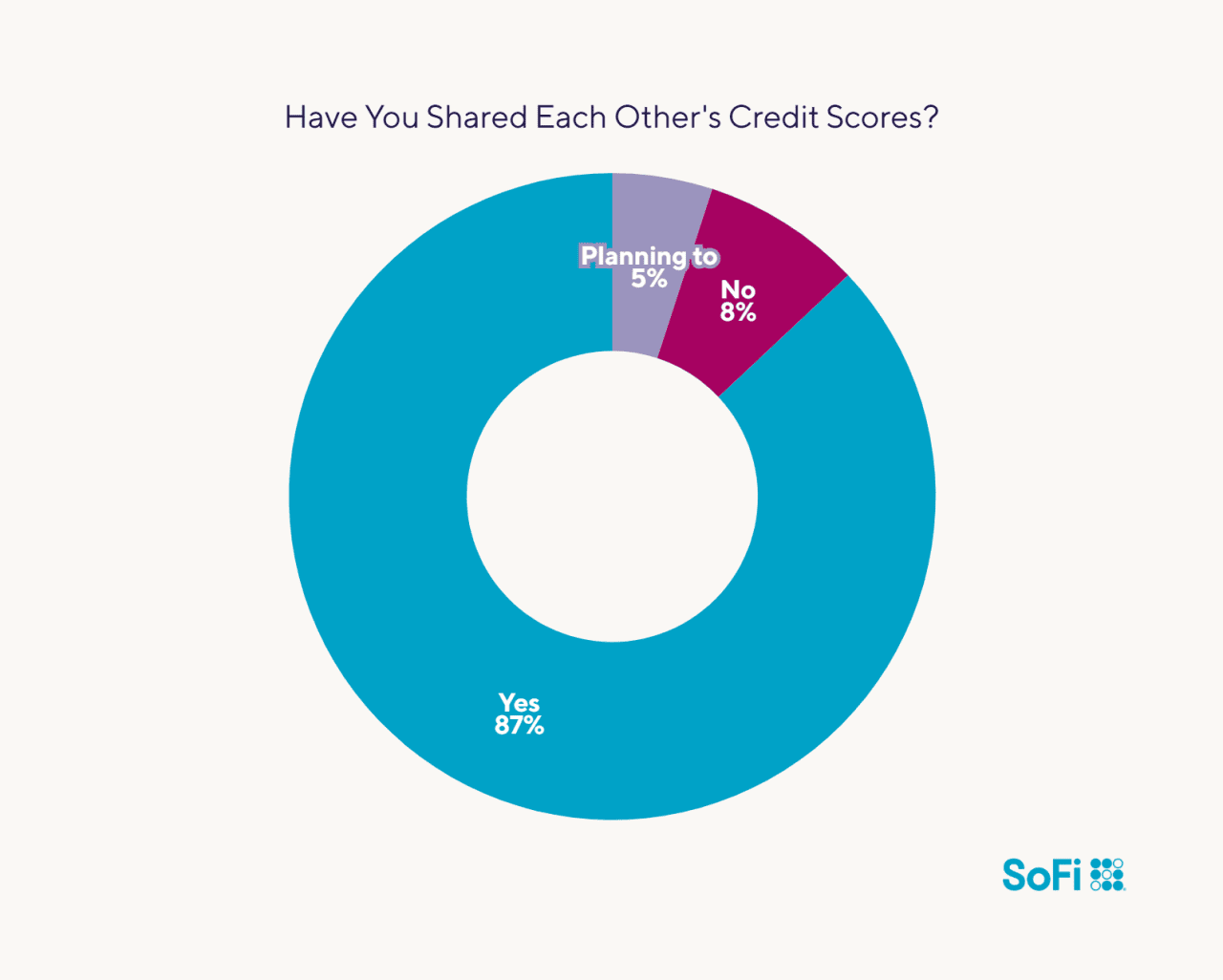

87% share credit scores

Even credit scores aren’t off limits to SoFi survey respondents. Most (87%) said they’ve told their partner what their credit score is. Only 8% haven’t shared this info, and 5% are planning to bring it up at some point. If you’d like to reveal your score to your partner, but you’re not sure what it is, there are ways to check your credit score for free.

SoFi

Joint finances and future planning

Many of SoFi’s Love and Money survey respondents are combining their money with their partners’ — even before marriage. Here’s how they’re managing money in their relationship.

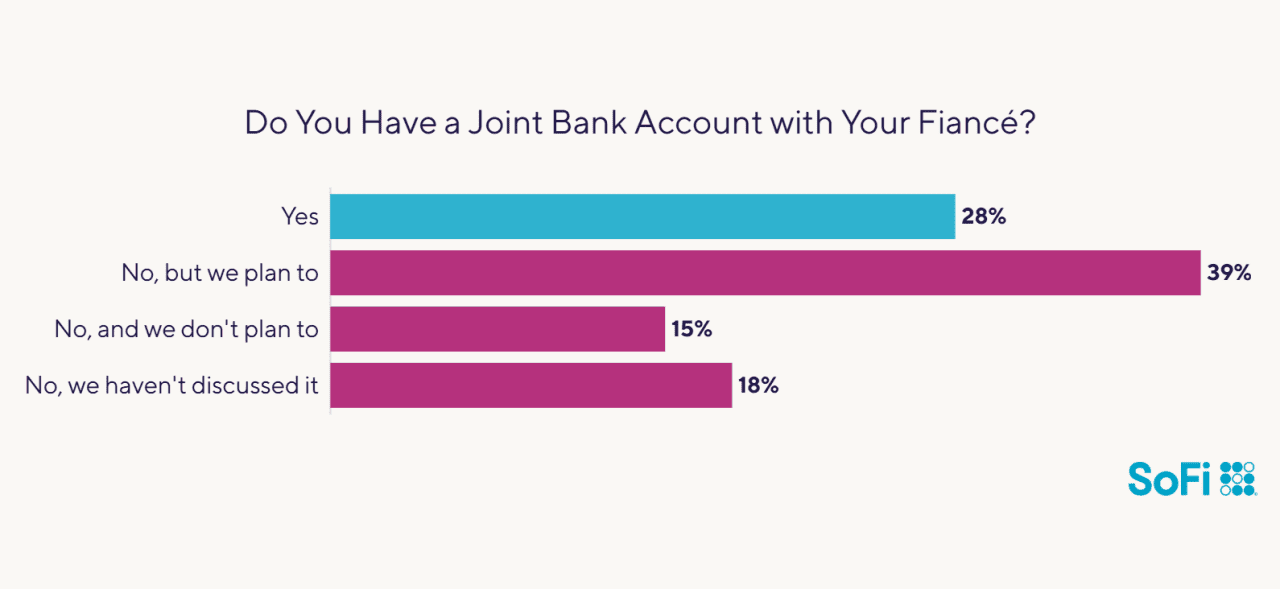

28% have a joint bank account

A joint bank account can make it easier for couples to manage household bills and other shared expenses. That may explain why, even before they tie the knot, nearly 30% of respondents have a joint account with their significant other, and 39% are planning to open an account together.

SoFi

However, whether to bank together is a highly personal decision, and some couples prefer to keep their money separate. In the SoFi survey, 15% of people said they don’t plan to open a joint account, and 18% said they haven’t talked about the idea yet.

Roughly 1 in 4 committed couples open a joint bank account before marriage.

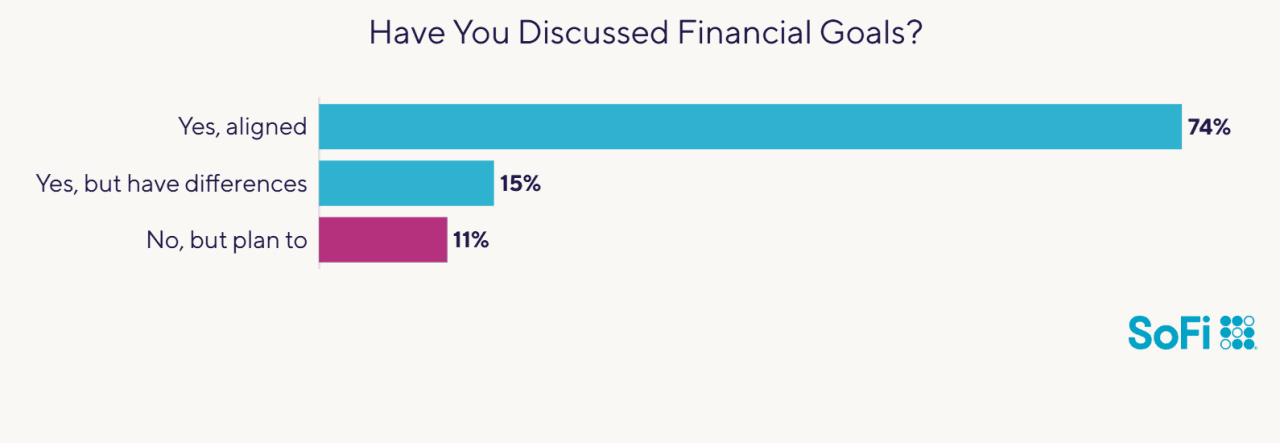

74% discuss their financial goals

Overwhelmingly, respondents to the survey report that they have discussed their long-term money goals and, in most cases, agree on what those goals are.

SoFi

Of the 74% who said they’ve discussed long-term goals and are aligned, their top financial objective is buying a home.

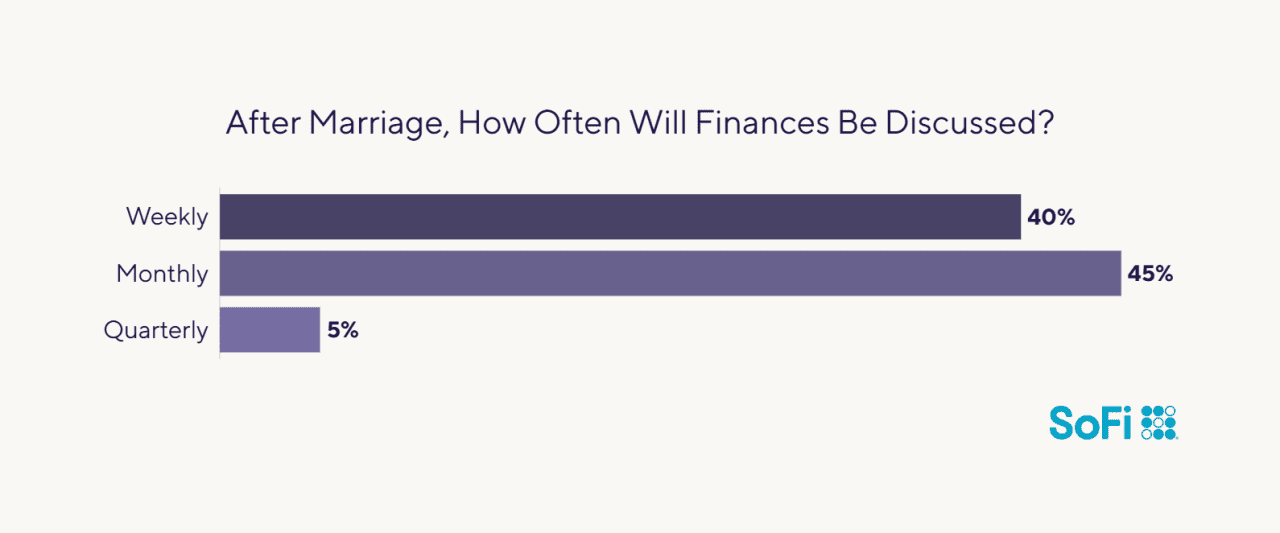

85% plan to discuss finances at least once a month after marriage

When it comes to love and money in a relationship, survey respondents aim to keep the lines of communication open after they get married. Eighty-five percent say they’ll talk about money monthly, while 40% are targeting weekly discussions.

SoFi

Financial experts agree with this approach: Regular money talks during marriage can help lower financial stress, reinforce that you are both on the same team, and help you work toward — and achieve — shared goals. Together, you may be able to problem-solve your issues, for instance.

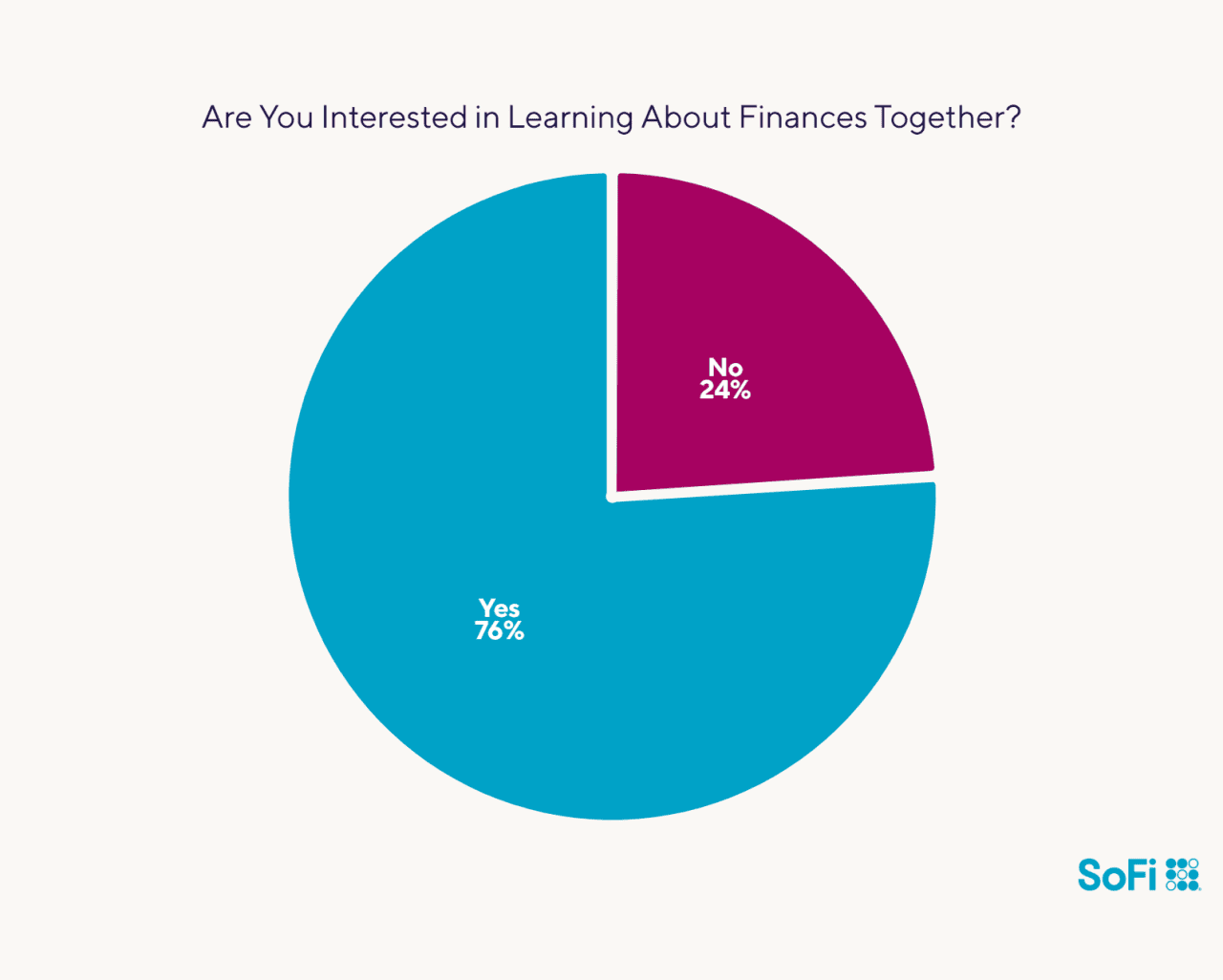

76% want to learn more about managing money together

It’s one thing to manage finances as a single person, but when you merge money and bills with a partner, the task can become even more complicated. No wonder then that more than three-quarters of SoFi survey respondents said they’re interested in learning more about managing finances as a couple.

SoFi

Some have already taken the first step: 16% have completed a financial education class with their significant other — even before saying “I do.”

Wedding finances: How to pay for the big day

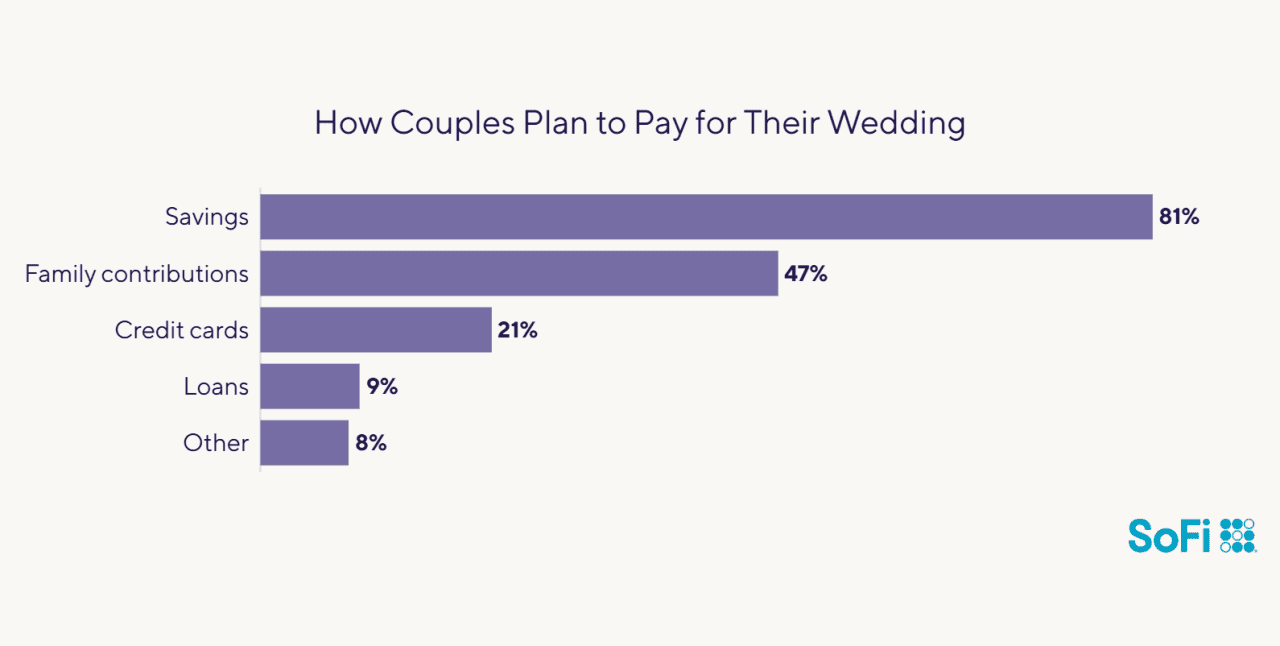

A wedding is a huge expense — the average wedding in the U.S. costs $33,000, according to The Knot. For many couples, figuring out how much to spend and how to pay for their wedding day is the one of the first major money issues they may confront together. SoFi’s survey uncovered these intriguing truths about wedding spending.

81% plan to use savings to pay for their wedding

Most couples want to foot at least some of their wedding bill themselves: 81% are aiming to put their savings toward it. But many couples also need financial help from family or plan to borrow the funds to help cover the cost of their big day.

This is how SoFi respondents’ answers break down (they selected all that apply to their situation).

SoFi

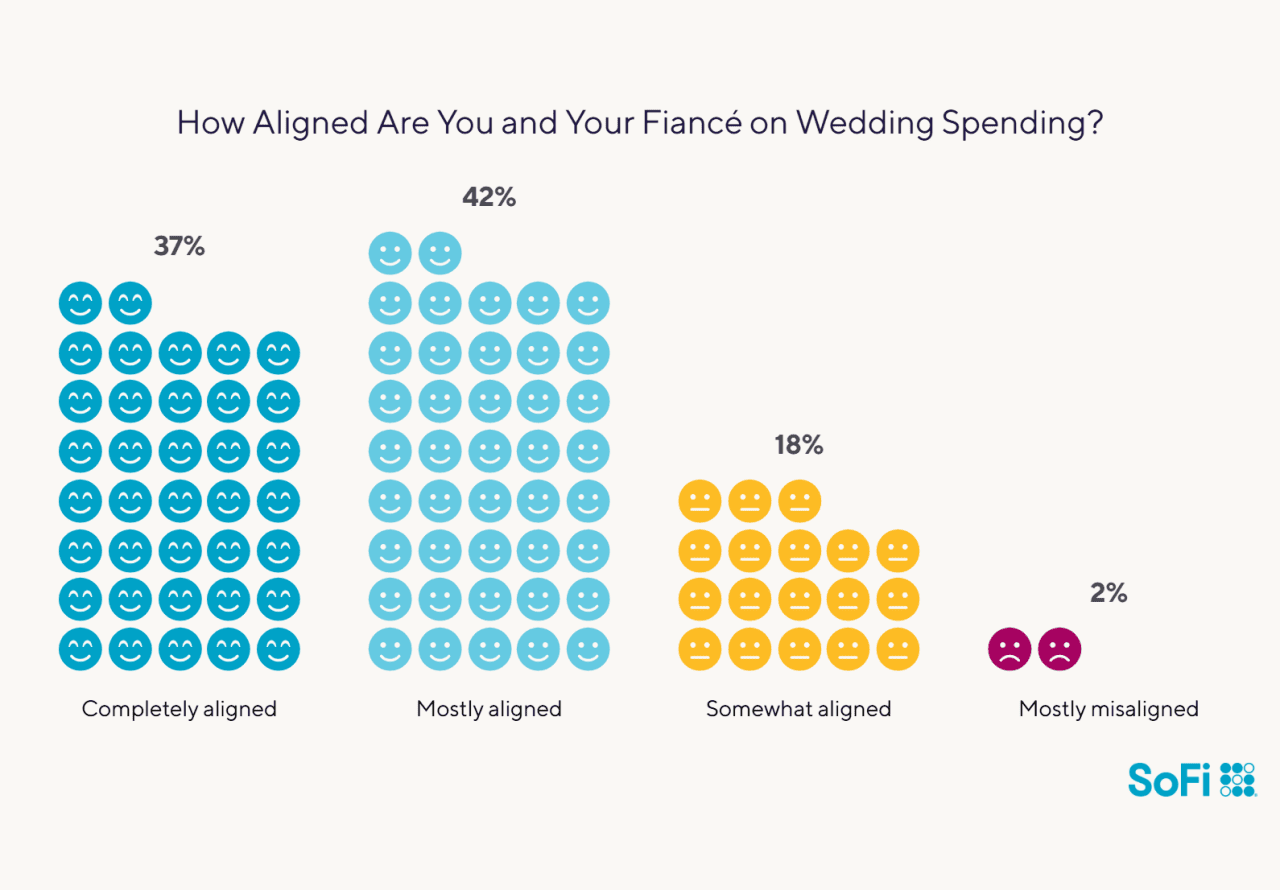

79% agree about wedding spending

Although you might think that wedding expenses could be a source of friction, the survey found that most couples are completely or mostly in agreement about how much money to spend and what to spend it on: 79% of respondents report being in sync about this, with 37% saying they completely agree.

SoFi

Another 18% are somewhat aligned on wedding spending, while 2% mostly disagree about it and less than 1% completely disagree.

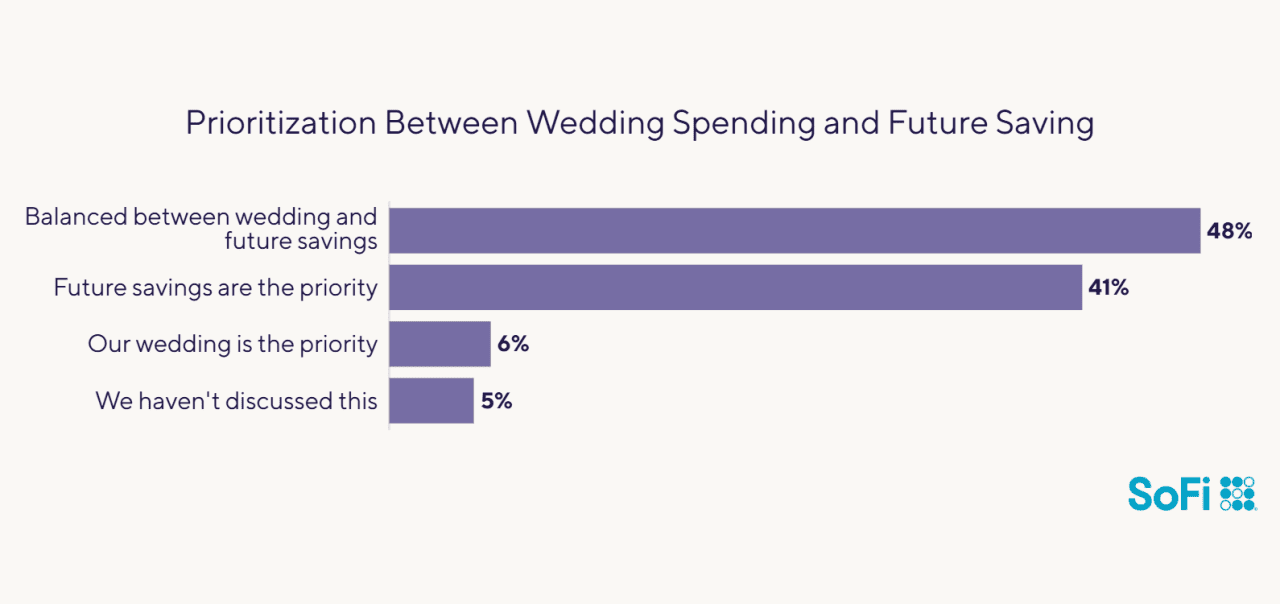

41% prioritize saving for their future over wedding spending

While a wedding is a milestone day in a couple’s relationship, saving for the future is also very important to respondents of SoFi’s Love and Money survey: A full 41% said putting money away for their future together is a bigger priority than paying for their wedding.

SoFi

A slightly larger group of respondents (48%) want to balance both wedding expenses and saving for the future. Just 6% prioritize saving for their wedding over saving for their future.

Savings strategies for couples who want to build a nest egg for their future could include opening a high-yield savings account, contributing to a 401(k) at work, and setting up an individual retirement account.

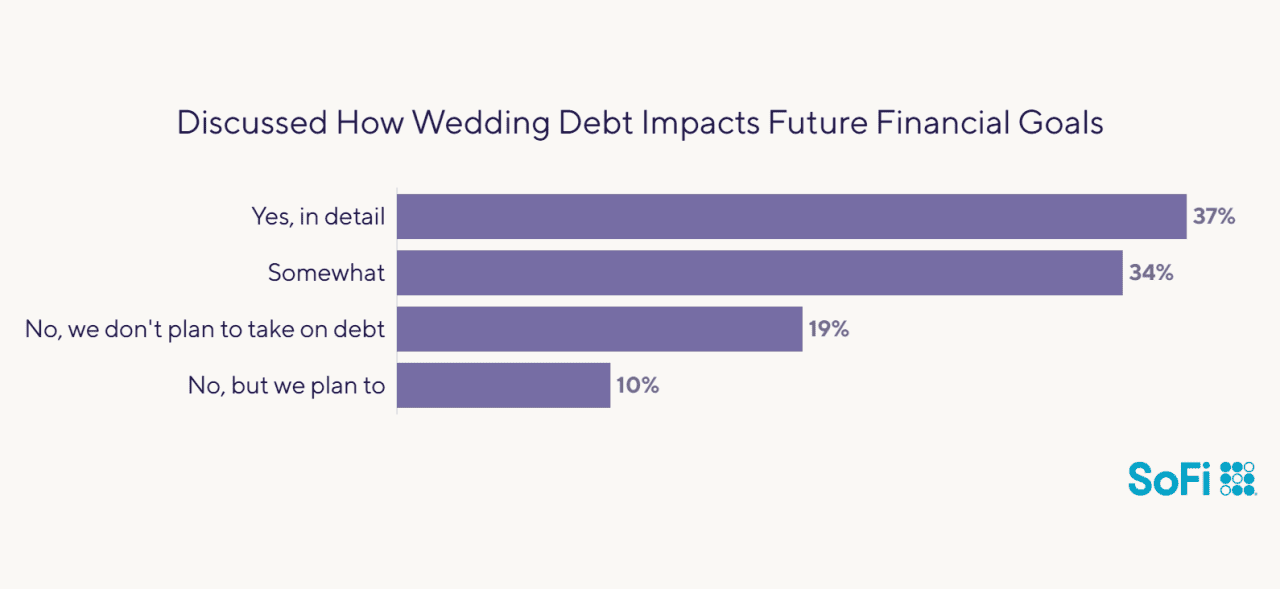

71% have discussed how wedding debt might impact their financial goals

Considering that the cost of a wedding can run well into the tens of thousands of dollars, as noted above, survey respondents are confronting the issue by talking about it. And almost 1 in 5 said they don’t plan to take on wedding debt.

SoFi

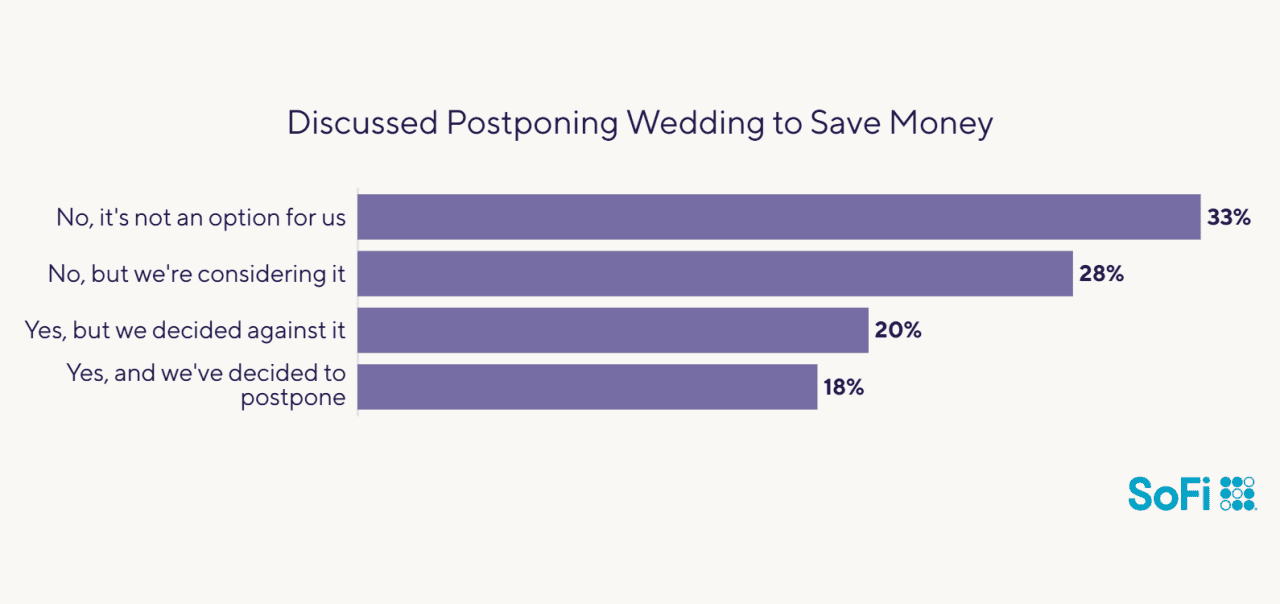

28% are considering postponing their wedding to save more money

When finances are tight, many respondents are willing to take action to avoid overspending and running up debt, even if it means putting off their big day. Almost 1 in 5 (18%) have already postponed their wedding day after discussing it with their partner. Another 28% report that they’re considering postponing their wedding, though they haven’t talked about the idea with their partner.

SoFi

For 33% of respondents, postponing is not an option, and 20% have discussed the idea but decided not to put off their wedding.

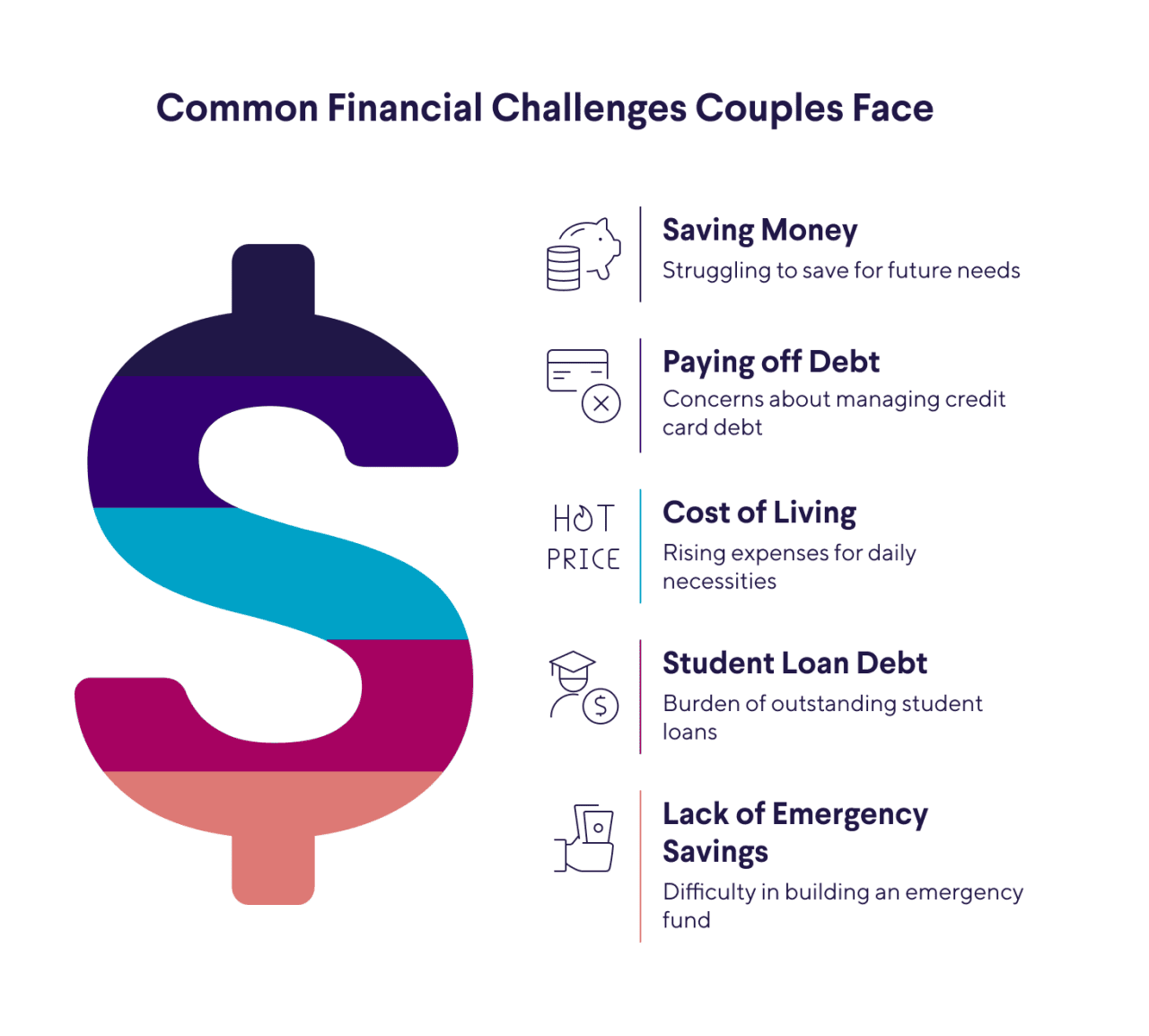

Common money challenges couples face

SoFi

When survey respondents were asked to share the largest financial challenge they and their partner are facing, this is what they said:

- Saving money: Whether it’s for a house, kids, or retirement, putting away money for the future is a struggle for many survey respondents.

- Paying off debt: Tackling credit card debt is a major concern many survey participants voiced.

- Cost of living: From housing to groceries to being able to pay the monthly utility bills, respondents say the cost of everything has gone up. “We live paycheck to paycheck,” several said.

- Student loan debt: Paying off outstanding student loans weighs heavily on the minds of a number of respondents.

- Lack of emergency savings: Trying to scrape together enough to create an emergency fund came up over and over with respondents.

Conflict and communication

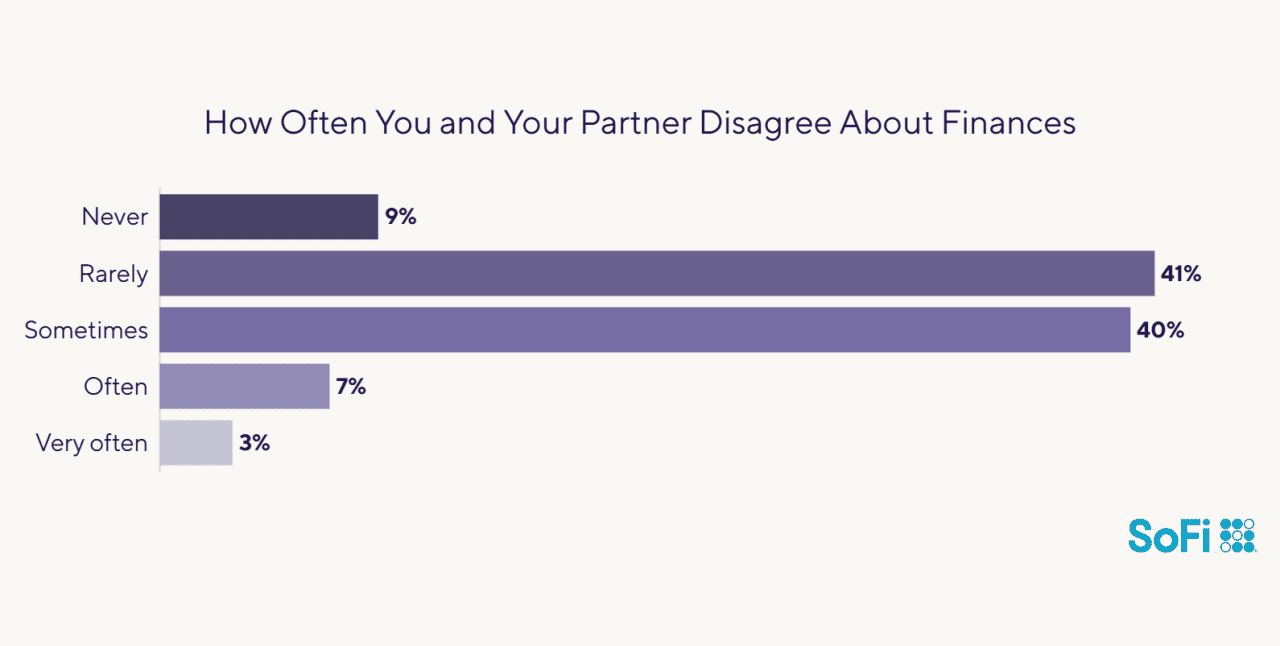

Numerous studies over the years have found that money is a common reason couples fight. But in SoFi’s 2024 Love and Money survey, just 10% of respondents said they often or very often argue about finances. Let’s call that progress!

41% rarely disagree about money

When asked how often they disagree about financial matters, the top answer was “rarely.”

SoFi

14% are considering a prenuptial agreement

Prenups are no longer just for the wealthy. Indeed, research suggests these legal contracts are growing in popularity, particularly among millennials and Gen Zs. Nevertheless, the survey suggests that only a minority of couples are on board with the idea.

SoFi

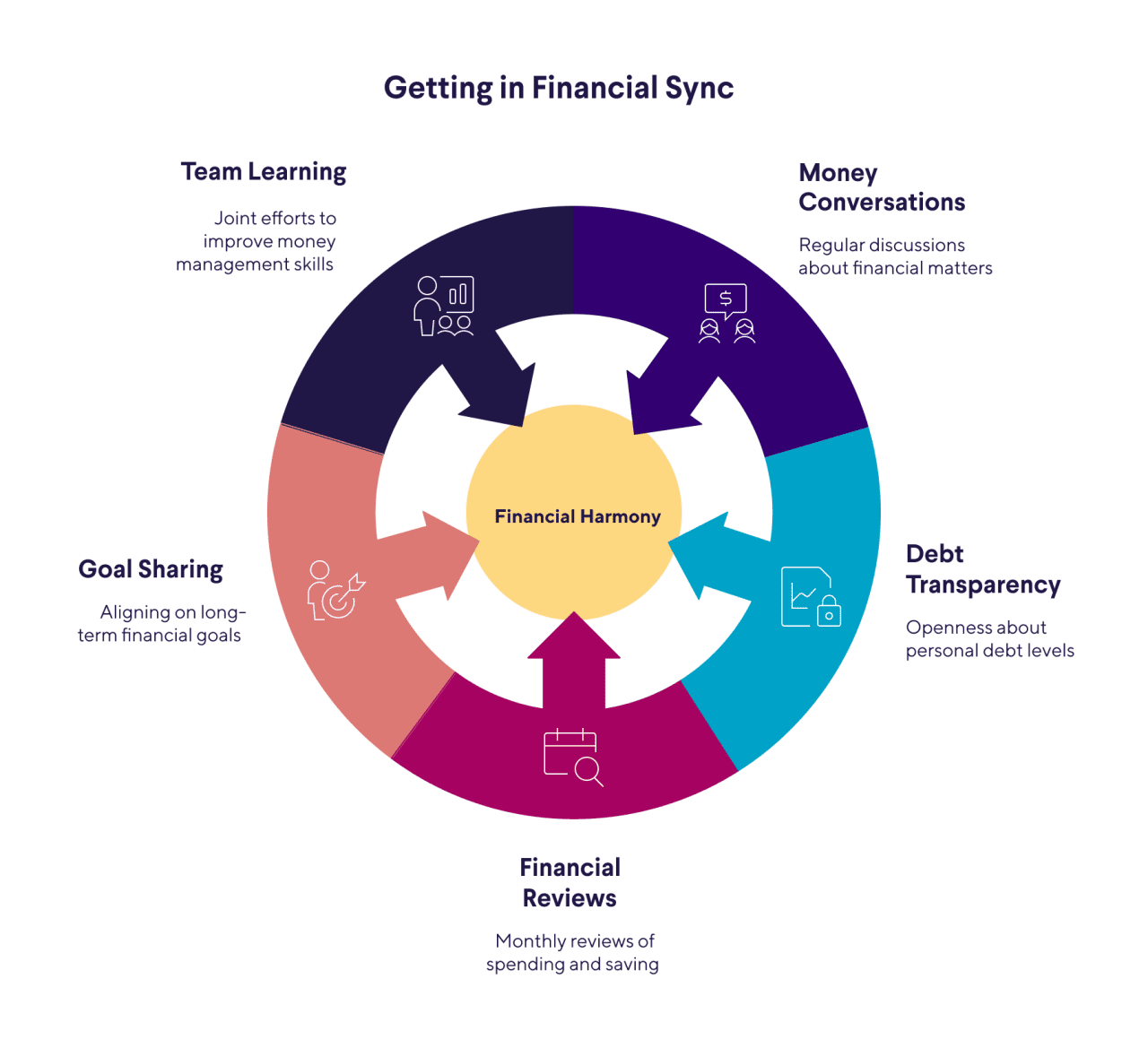

Couples are working on communication

SoFi

A large share of SoFi survey respondents are practicing helpful techniques to get in sync financially and work toward their goals together. These strategies include:

- Having money conversations. Couples made it clear that they talk about money issues, from credit scores to spending and saving. Three-quarters said they are very comfortable discussing money issues.

- Coming clean about the uncomfortable stuff. 83% of participants have been completely transparent with their partner about the amount of debt they owe.

- Staying on top of spending and saving. 85% plan to review their finances together at least monthly.

- Sharing their goals. Talking about long-term goals and being aligned on them is something 74% of respondents do.

- Working as a team to improve their money skills. 76% percent are eager to learn more about managing money as a couple.

The takeaway

Overall, couples who live together and plan on getting married are surprisingly in sync about their finances and their savings goals, according to findings from SoFi’s 2024 Love and Money survey.

Three-quarters of respondents are comfortable discussing money matters with their partner, and nearly as many are aligned about their financial goals for the future. The majority of survey participants share the details about the debt they owe and their credit scores. And 41% said they rarely disagree about finances.

However, respondents also acknowledge that they don’t always agree on money issues and struggle with a number of financial challenges, including saving for the future. Opening a joint bank account to save for emergencies and other goals is one way couples can take charge of their finances.

About the Survey

SoFi’s Love and Money Survey was conducted on August 22-23, 2024, and included 450 U.S. adults aged 18 and over who were living with their partner, had discussed marriage with their partner, and were likely to get married within the next three years.

Percentages were rounded to the nearest whole number, so some percentages may not add up to 100%.

This story was produced by SoFi and reviewed and distributed by Stacker.

![]()