Where cash is king: States with the most all-cash home sales

Billion Photos // Shutterstock

Where cash is king: States with the most all-cash home sales

How common are all-cash home sales? The mortgage process hasn’t gotten any faster, but buyers in some markets have, HouseCashin reports.

Some 27% of all real estate transactions are all-cash deals, according to an analysis of ATTOM data by New American Funding. That means when a homeowner is ready to sell, the buyer doesn’t always need a mortgage preapproval, but rather just wire transfer details, an escrow account, and a deed.

Sellers prefer cash deals when they need to get out of their home fast, either for a life-changing event like relocation, or because the property has gotten too costly. In such scenarios, investors can save the day by offering these sellers a lump-sum infusion of cash, sometimes even faster than an agent can get the “FOR SALE” sign hammered into the front yard.

Key all-cash home sale findings:

- West Virginia is the leader in cash sales, with about 41.1% of homes being sold for cash.

- Investors buying vacation homes or rentals account for about half of all cash-buying activities.

- Cash sales have declined in popularity since the peak of the COVID-19 pandemic.

- Hawai’i tops the list of the states with the highest increase in the number of all-cash buyers at the rate of +11.54% since last year.

The Surge of Cash Deals During the COVID-19 Pandemic

Cash deals aren’t exclusively for owners who need an exit plan, however. The frequency of cash deals exploded during the COVID-era housing market, when inventory was tight and interest rates were at all-time lows. Cash deals had the power to quadruple buyers’ chances of acceptance, one 2021 Redfin study found.

“Home buyers had to sweeten offers by going over asking price, waiving contingencies and even going all cash,” said Doug Perry, strategic financing advisor at Real Estate Bees, a marketing platform for real estate professionals.

Yet, cash deals weren’t foolproof. Competition still weeded buyers out. One D.C. real-estate agent in 2021 reported receiving 76 all-cash offers on her suburban, fixer-upper home.

And as Kristina Morales, Cleveland-based licensed mortgage loan originator and real estate agent, observed during the pandemic, cash deals did not mean an automatic discount on price.

“In fact, cash buyers were still paying over the list price,” Morales said. “Cash provided the edge when sitting next to 50 other offers.”

All-Cash Deals Today

All-cash deals rode a dramatic popularity high through the first quarter of 2024, according to the National Association of Realtors (NAR), before falling back to pre-pandemic levels later in the year.

Today, investors buying vacation homes or rentals account for about half of all cash-buying activity. And a cash offer in the current market may once again provide some leverage on price, says Morales—but bets are still off when the buyer is in a multiple-offer situation. “Despite high rates, low inventory keeps housing prices elevated and the potential for multiple offers fairly high,” she said.

While nationwide, all-cash offers are less common in 2025 than in 2024, deals haven’t slowed in some hot markets. Ahead, online home-selling platform HouseCashin compiled national and regional data from independent mortgage lender New American Funding (NAF) to show where all-cash sales are most common, with market estimates from HouseCashin and the Zillow Home Value Index to contextualize the uptick with concrete figures.

The list breaks down the top 10 states for all-cash real estate deals in 2024, followed by a snapshot of the remaining 40, looking at where the frequency of all-cash deals spiked the most. This article will also explore the economic and demographic forces that could be fueling the rise in cash purchases today and look at what homeowners should expect when entertaining an all-cash bid.

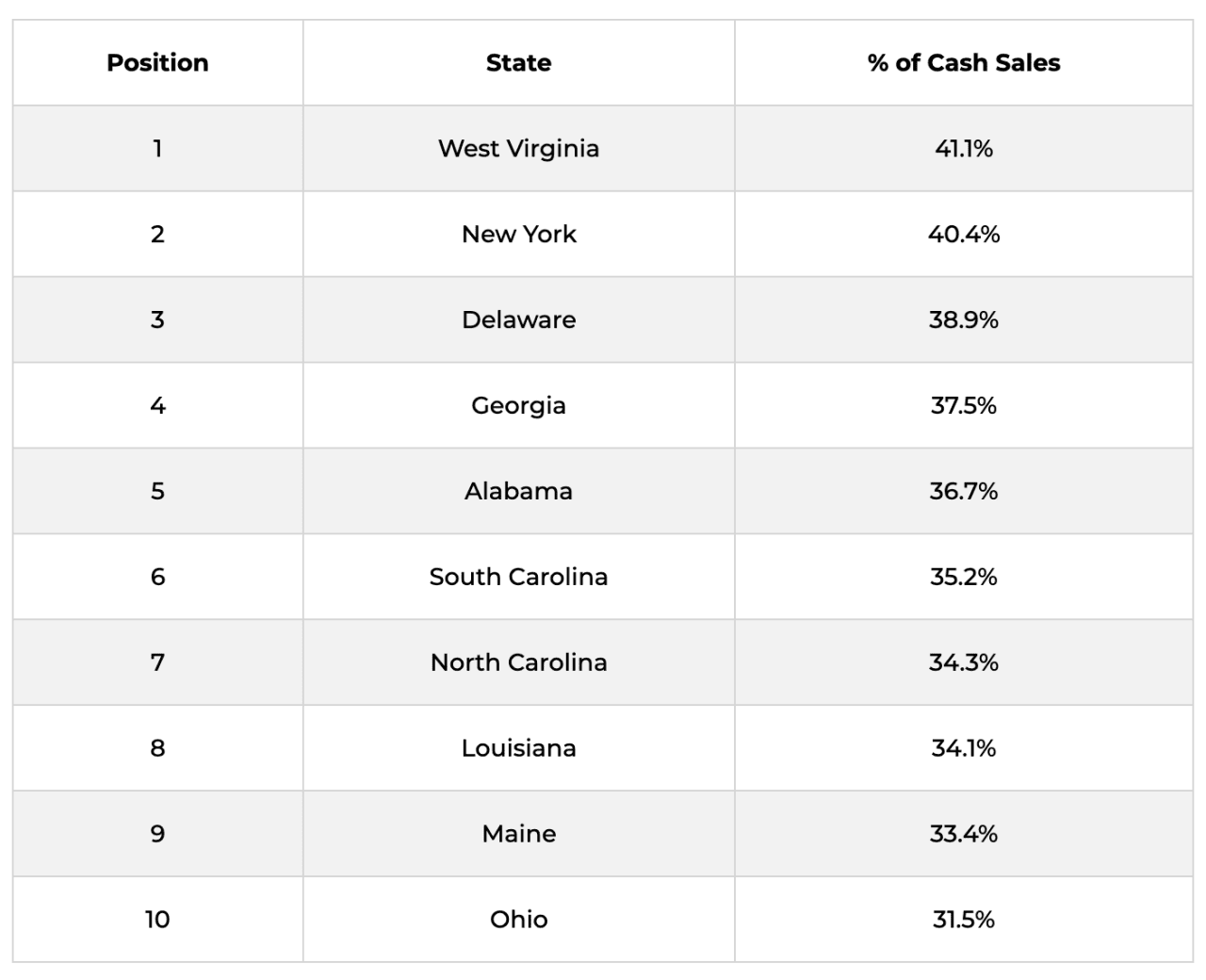

States where all-cash deals are most common

HouseCashin

Ohio (31.5% of deals are cash sales)

Coming in at No. 10 is the Buckeye State, where 31.5% of homes were purchased with cash in 2024. According to Zillow, the typical Ohio home value has risen 3.4% in the past year to $242,897 in 2025. Meanwhile, HouseCashin estimates property taxes have also increased by 27.82% in 10 years.

Ten Ohio counties have experienced a double-digit upswing in all-cash sales since the year prior, which isn’t surprising given the state’s affordability. They are:

- Morrow County: from 39% to 47% (+20.5%)

- Hardin County: from 33% to 38% (+15.2%)

- Erie County: from 31% to 35% (+12.9%)

- Marion County: from 32% to 36% (+12.5%)

- Monroe County: from 42% to 47% (+11.9%)

- Ottawa County: from 35% to 39% (+11.4%)

- Athens County: from 35% to 39% (+11.4%)

- Pickaway County: from 28% to 31% (+10.7%)

- Defiance County: from 29% to 32% (+10.3%)

- Shelby County: from 29% to 32% (+10.3%)

Morales says in Cleveland, cash offers commonly come from out-of-state buyers moving to the area from a higher-cost area: “The Cleveland market is always a strong market for investors because of the relatively low acquisition costs and good rental income,” she said. “I also see it from parents buying property for their child.”

As far as getting over asking, it’s a coin toss: about 1 in 3 homes (35.9%) are selling for more than their listing price, while nearly half go for under (46.4%). In a market this mixed, smart pricing and building relationships with the right buyer make all the difference in how your listing performs.

Maine (33.4% of deals are cash sales)

In this scenic state with 3,500 miles of coastline, homes sold for cash 33.4% of the time in 2024 and in 2025 are valued at $416,948 on average. That value is up 1.1% over the past year.

Not every property sells for its listing price, however. Zillow reports the median list price is $429,300, while the median sale price is slightly lower, at $391,667. A reported 36.1% of homes sell for over list price, and 47.8% sell under.

Piscataquis County saw the largest uptick in all-cash home purchases in Maine, with cash deals rising from 38% in 2023 to 39% in 2024 according to NAF data. That’s a 2.6% increase.

According to data from HouseCashin, property taxes in Maine have crept up by 35.53% in the past 10 years, which may be a contributing factor motivating sellers to offload their houses.

Louisiana (34.1% of deals are cash sales)

Our former French colony is experiencing an epic surge in cash home sales. Here, 34.1% of homes across the state sold for cash in 2024. In its leading county, Madison Parish, that rate is higher at 45%, nearly double its 2023 percentage.

As you can see, the growth of cash home sales varies drastically among Louisiana’s top 10 counties:

- Madison Parish: from 23% to 45% (+95.7%)

- Union Parish: from 34% to 44% (+29.4%)

- West Feliciana Parish: from 47% to 59% (+25.5%)

- West Baton Rouge Parish: from 20% to 25% (+25.0%)

- Iberville Parish: from 21% to 26% (+23.8%)

- Ouachita Parish: from 42% to 50% (+19.1%)

- Jefferson Davis Parish: from 27% to 32% (+18.5%)

- De Soto Parish: from 47% to 54% (+14.9%)

- Jackson Parish: from 62% to 71% (+14.5%)

- Rapides Parish: from 21% to 24% (+14.3%)

Home values are rising in the northeastern corner of Louisiana, where quaint cities like Tallulah invite residents to go birding under the shade of cypress and tupelo trees. Compared to the rest of the state, which is seeing a 1.4% drop in home values, Tallulah’s properties are up 1.3%, and it’s still extremely affordable, with home values averaging just $79,778 compared to typical Louisiana property values, which average $212,343 statewide.

Property tax is hitting Louisiana homeowners exceptionally hard: HouseCashin data shows taxes across the state have risen a staggering 74.32% over the past decade.

North Carolina (34.3% of deals are cash sales)

Whether they’re eager to trek the scenic Blue Ridge mountains or pick sunflowers in the Piedmont, North Carolina buyers are offering up cash for their new homes. An estimated 34.3% of real estate deals in 2024 were all-cash transactions in North Carolina.

Today, the average 2025 home value in North Carolina is $337,457, a slight 0.6% dip from last year. According to Zillow, listings move to “pending” in about 18 days, though 56.3% of sales in 2025 are currently selling for under the listing price.

These North Carolina counties had the biggest jump in cash sales from 2023 to 2024:

- Columbus County: from 35% to 61% (+74.3%)

- Gates County: from 30% to 41% (+36.7%)

- Duplin County: from 34% to 43% (+26.5%)

- Hertford County: from 42% to 53% (+26.2%)

- Cherokee County: from 43% to 54% (+25.6%)

- Mitchell County: from 45% to 55% (+22.2%)

- Bertie County: from 41% to 50% (+22.0%)

- Hoke County: from 28% to 34% (+21.4%)

- Davie County: from 32% to 37% (+15.6%)

- Hyde County: from 45% to 52% (+15.6%)

Property tax increases have been more moderate in North Carolina, growing 28.55% over the last decade, according to HouseCashin data.

South Carolina (35.2% of deals are cash sales)

An estimated 35.2% of 2024 real estate sales in South Carolina were cash deals, according to NAF data. The average Palmetto State home value is $304,173, down slightly by 0.3% from 2024.

While South Carolina’s cash-sale spikes are not extremely dramatic—counties saw jumps between 7.4% and 27.3%—the state is among the top-three states with increasing mortgage delinquency rates. That, along with more natural disasters (and expensive insurance premiums), suggests that more cash sales might be on the horizon.

One factor that may temper buyer interest, however, is excess supply: South Carolina received an “A” marking on Realtor.com’s housing affordability report card in April because its property development efforts are currently outpacing demand. Meanwhile, property taxes have increased at a rate of about 31% over the last 10 years.

These counties had the largest positive rate change in cash offers from 2023 to 2024:

- Colleton County: from 33% to 42% (+27.3%)

- Barnwell County: from 32% to 40% (+25%)

- Allendale County: from 65% to 81% (+24.6%)

- Hampton County: from 39% to 45% (+15.4%)

- Florence County: from 33% to 38% (+15.2%)

- Lee County: from 33% to 38% (+15.2%)

- Cherokee County: from 31% to 35% (+12.9%)

- York County: from 26% to 29% (+11.5%)

- Clarendon County: from 42% to 46% (+9.5%)

- Richland County: from 27% to 29% (+7.4%)

Alabama (36.7% of deals are cash sales)

Secret’s out on this hidden gem: Between 2022 and 2023, Alabama’s population grew by 34,000 people, ranking as the eighth-highest state for inbound moves.

Between white sand beaches and notable cities steeped in Civil Rights history, it doesn’t take much to persuade buyers to take advantage of Alabama’s affordable housing market, where the average home value today is $234,052.

Zillow estimates that 19.1% of homes in Alabama sell for over the listing price, after sitting on the market for about 23 days. Property taxes statewide have risen a moderate 33.46% over the past 10 years.

Cash offers represented 36.7% of all 2024 real estate deals in Alabama, with the following counties demonstrating the most growth from the year prior:

- Jefferson County: from 40% to 57% (+42.5%)

- Covington County: from 30% to 38% (+26.7%)

- Geneva County: from 32% to 38% (+18.8%)

- Tuscaloosa County: from 45% to 53% (+17.8%)

- Madison County: from 27% to 31% (+14.8%)

- Fayette County: from 39% to 44% (+12.8%)

- St. Clair County: from 25% to 28% (+12%)

- Chilton County: from 34% to 37% (+8.8%)

- Houston County: from 29% to 31% (+6.9%)

Georgia (37.5% of deals are cash sales)

Along with South Carolina, the Peach State is experiencing economic factors driving more mortgage foreclosures. For one, property taxes have swelled a bit, growing 30.45% in the past decade (one HousingWire article reported that bump has equaled about $700 in the past five years). And while average home values, at $335,963, are below the national median sale price of $410,800, prices have leapt by 65% since 2019.

It’s therefore no surprise that Georgia is among the top 10 states for cash home sales. Statewide, an estimated 37.5% of 2024 deals were cash offers. These are the counties where the frequency of cash sales increased most:

- Schley County: from 36% to 49% (+36.1%)

- Calhoun County: from 32% to 42% (+31.3%)

- Baker County: from 35% to 45% (+28.6%)

- Bacon County: from 47% to 60% (+27.7%)

- Pulaski County: from 33% to 41% (+24.2%)

- Pickens County: from 35% to 43% (+22.9%)

- Treutlen County: from 40% to 49% (+22.5%)

- Morgan County: from 35% to 42% (+20%)

- Echols County: from 30% to 36% (+20%)

- Marion County: from 43% to 51% (+18.6%)

Delaware (38.9% of deals are cash sales)

One county is doing the heavy lifting in Delaware: Kent County, where the rate of cash sales jumped from 32% to 38% (+18.8%) from 2023 to 2024. Zillow estimates the average home value in Delaware today is $405,948, up 1.9% from last year. In this tax-haven state, property taxes have risen by a steady 31.76% over the last 10 years.

New York (40.4% of deals are cash sales)

Even in a mayoral election year, which some speculate is giving New York real estate buyers pause, the Empire State was the No. 2 highest for cash deals in 2024. The most expensive state on the list, average home values in New York are $508,154, according to Zillow, which is up an impressive 4.7% since 2024. Alongside these jumps are, of course, a steady increase in property taxes, which have swelled 46.02% in the past 10 years. Meanwhile, an encouraging 44.8% of homes sell for above their listing price.

Cash deals in New York make up over 40% of real estate sales, with the following counties experiencing the most growth:

- Clinton County: from 31% to 49% (+58.1%)

- St. Lawrence County: from 25% to 32% (+28%)

- Oneida County: from 38% to 46% (+21.1%)

- Chautauqua County: from 43% to 50% (+16.3%)

- Westchester County: from 26% to 30% (+15.4%)

- Cattaraugus County: from 46% to 53% (+15.2%)

- Cortland County: from 44% to 50% (+13.6%)

- Ulster County: from 46% to 52% (+13%)

- Herkimer County: from 47% to 53% (+12.8%)

- Wyoming County: from 34% to 38% (+11.8%)

West Virginia (41.1% of deals are cash sales)

John Denver is no longer West Virginia’s biggest fan, as the mountainous state recently ranked the No. 1 destination for inbound movers. Yes, while snowbirds and retirees fly to the Carolinas, Florida, Alabama and Arkansas, a significant flock of them also landed in West Virginia, causing a 65% inbound population flow—more than any other state.

Affordability is one big attraction: The average West Virginia home value is $169,928, up 2.3% from 2024, yet it still remains the state with the highest%age of homeowners. Some 75.4% of people own their homes in West Virginia, according to HouseCashin’s home ownership data, compared to the lowest state, New York, which comes in at 54.8%.

However, property taxes in West Virginia have jumped 39.97% in the past decade, according to data from HouseCashin.

An estimated 41.1% of real estate deals in West Virginia were made with cash in 2024. These counties saw the largest leap:

- Wood County: from 28% to 56% (+100%)

- Wayne County: from 38% to 57% (+50%)

- Gilmer County: from 46% to 62% (+34.8%)

- Jefferson County: from 22% to 26% (+18.2%)

- Roane County: from 51% to 60% (+17.7%)

- Marshall County: from 44% to 51% (+15.9%)

- Upshur County: from 68% to 76% (+11.8%)

- Lewis County: from 47% to 52% (+10.6%)

- Monongalia County: from 40% to 44% (+10.0%)

- Wyoming County: from 66% to 71% (+7.6%)

States with the highest increase in all-cash buyers

Some states saw dramatic growth for cash offers in 2023 and 2024, and even outpaced states where a higher amount of cash transactions took place:

- Hawaii: from 26% to 29% (+11.54%)

- Oregon: from 22% to 24% (+9.09%)

- South Dakota: from 17% to 18% (+5.88%)

- Alabama: from 34% to 36% (+5.88%)

- West Virginia: from 39% to 41% (+5.13%)

- District of Columbia: from 20% to 21% (+5.00%)

- Kansas: from 20% to 21% (+5.00%)

- Colorado: from 24% to 25% (+4.17%)

- Nevada: from 24% to 25% (+4.17%)

- Texas: from 25% to 26% (+4.00%)

Three of these states—Colorado, Oregon and Texas—also happen to be popular states for real estate investors, according to data from HouseCashin. Characteristic signs of a hot investor market include rising rent prices—rents have jumped 56.69%, 47.55% and 37.66%, respectively, in the above states—along with steady property appreciation.

Morales argues that today’s high mortgage rates could also be contributing to the spike in cash sales: “With higher interest rates, buyers are paying cash or very large down payments to avoid higher interest,” she explained.

However, she adds that higher rates have also reduced the buyer pool, so with the decrease in competition, some buyers who could pay cash choose not to since the need to outbid other buyers is not as intense. Like all things money-related, these factors are wholly personal and depend on the buyers’ priorities.

Top counties in the remaining states

While these states didn’t make the superlative list, some of the leading counties inside them tripled or quadrupled their cash-sale amounts from 2023 to 2024:

Alaska

Southeast Fairbanks Census Area: from 1% to 4% (+300%)

Arizona

Graham County: from 23% to 27% (+17.4%)

Arkansas

Chicot County: from 17% to 41% (+141.2%)

California

Sierra County: from 23% to 31% (+34.8%)

Connecticut

Statewide (no county data): 23.9% of homes purchased with cash in 2024

Florida

Baker County: from 19% to 24% (+26.3%)

Idaho

Butte County: from 15% to 28% (+86.7%)

Illinois

DeKalb County: from 22% to 32% (+45.5%)

Indiana

Pulaski County: from 31% to 41% (+32.3%)

Iowa

Tama County: from 2% to 6% (+200%)

Kentucky

Jackson County: from 4% to 17% (+325%)

Massachusetts

Nantucket County: from 34% to 39% (+14.7%)

Michigan

Tuscola County: from 19% to 25% (+31.6%)

Minnesota

Rock County: from 26% to 36% (+38.5%)

Mississippi

Walthall County: from 3% to 24% (+700%)

Missouri

Wayne County: from 19% to 63% (+231.6%)

Montana

McCone County: from 12% to 17% (+41.7%)

Nebraska

Brown County: from 5% to 24% (+380%)

New Hampshire

Statewide (no county data): 28.4% of homes purchased with cash in 2024

New Jersey

Somerset County: from 20% to 22% (+10%)

New Mexico

Guadalupe County: from 29% to 42% (+44.8%)

North Dakota

Bottineau County: from 2% to 10% (+400%)

Oklahoma

Okfuskee County: from 17% to 28% (+64.7%)

Pennsylvania

McKean County: from 16% to 29% (+81.3%)

Rhode Island

Newport County: from 34% to 37% (+8.8%)

Tennessee

Van Buren County: from 40% to 59% (+47.5%)

Utah

Tooele County: from 19% to 28% (+47.4%)

Vermont

(No available data)

Virginia

Augusta County: from 23% to 38% (+65.2%)

Washington

Walla Walla County: from 22% to 28% (+27.3%)

Wisconsin

Calumet County: from 13% to 28% (+115.4%)

Wyoming

Carbon County: from 9% to 10% (+11.1%)

What to expect when entertaining a cash bid

Cash offers may sound like the holy grail, but it’s important to know what green flags to look out for that indicate your deal will go through.

“The reality is not all cash buyers are as they appear,” cautions Perry. Outside of specialized companies that buy houses for cash, which often have capital ready to deploy on a big purchase, he says a “very small few” of individual buyers actually have the available cash to complete the transaction.

The most common way for individuals to have cash ready to go is if they’ve already sold their departing residence and have the liquid proceeds from that sale. Others might have to look into creative financing like Buy Before You Sell (BBYS) loans or Home Equity Investments (HEI) options that involve an investor, says Perry.

When you find the right buyer, however, cash sales can have enormous benefits. Most notably, there are fewer contingencies when selling to someone outright, meaning you don’t have to wait for financing or inspections like you would with a traditional mortgage. Of course, buyers can always request an inspection, but because a third-party lender is not involved, nobody will require that due diligence.

The closing process is often more simplified, as well, thanks to having fewer papers to sign. Parties will need to prepare the title and deed, along with a settlement statement summarizing seller closing costs. You’ll still need to involve a title company and escrow account, however, but without a financier there’s more flexibility to shop around for the right one.

While rates and market dynamics will always shift, one thing is certain: Cash deals are a viable option in counties across the U.S. Whether you’re a buyer hoping to stand out or a seller weighing your offers, cash remains a powerful—if somewhat unpredictable—player in today’s housing market.

This story was produced by HouseCashin and reviewed and distributed by Stacker.

![]()